6 essential bookkeeping tools every business owner should know about

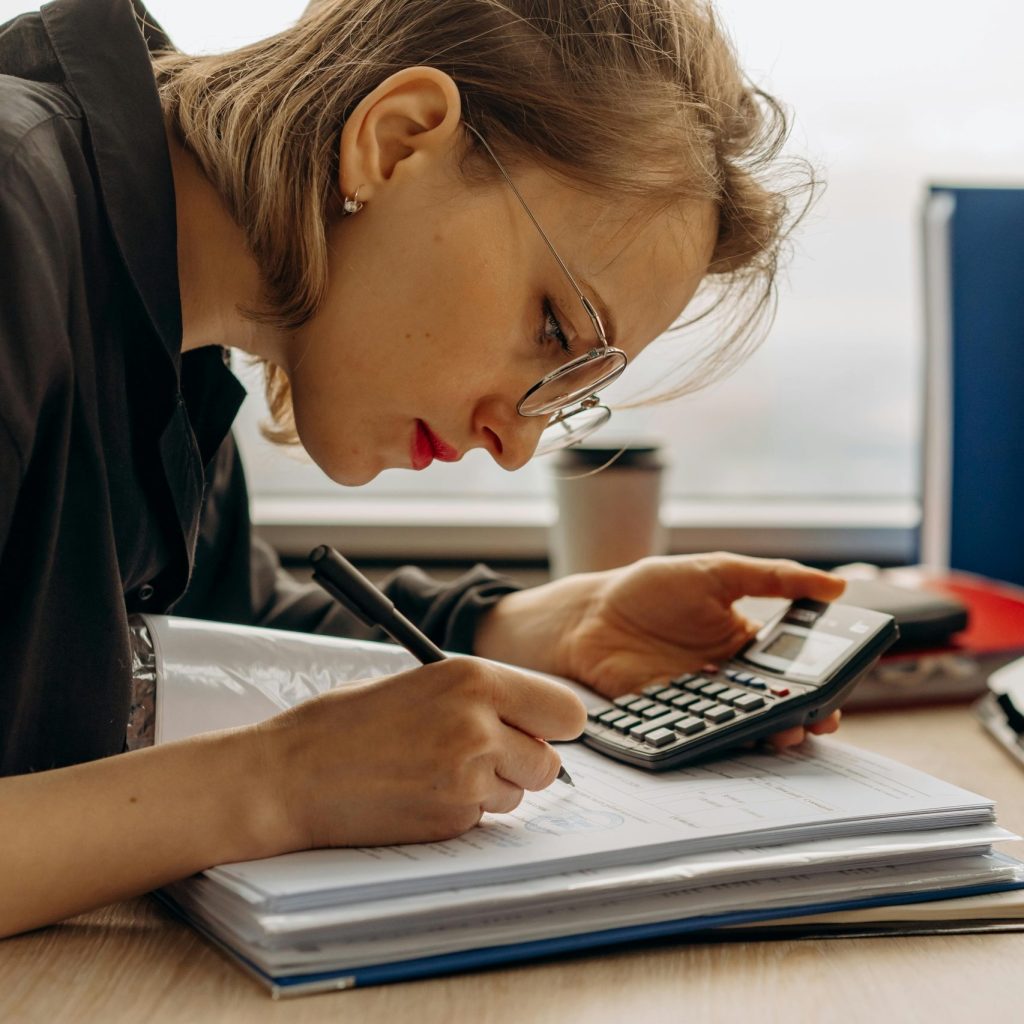

Let’s be honest, bookkeeping is rarely the highlight of a business owner’s day. But the good news? It’s come a long way. Thanks to cloud-based tools, managing your finances doesn’t have to be a time-consuming headache. The right tools can make bookkeeping quicker, easier, and more efficient. If you’re still buried in paper receipts or […]

6 essential bookkeeping tools every business owner should know about Read More »